Structured Financial Products

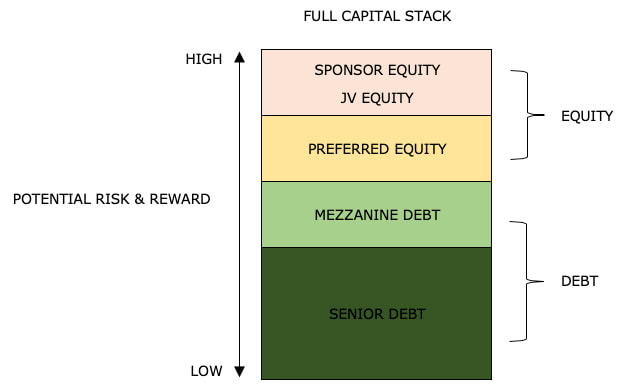

Our company can arrange structured commercial products including joint venture equity, preferred equity, and mezzanine financing for investors who are acquiring new commercial real estate or sponsors who are seeking to recapitalize / restructure their existing assets.

|

JOINT VENTURE EQUITY

Joint venture equity represents a capital investment that is junior to both senior debt and preferred equity. Joint venture equity is typically structured as a partnership (LLC) between the project sponsor (general partner) and the equity investor (limited partner). The sponsor is responsible for sourcing the deal and executing the investment plan while the equity investor contributes capital. Joint venture investors typically do not receive any preferred rate of return nor do they receive any priority return of invested capital. PREFERRED EQUITY

Preferred equity is a capital investment that is junior to senior debt, but senior to joint venture equity and common equity provided by the sponsor. Preferred equity can take on a variety of structure variations, but typically involves a fixed annual rate of return paid from cash flow along with an accrued return on investment to be paid from a future capital event. The preferred equity position is riskier than senior debt and preferred return rate is higher than the interest rate carried on project debt. Preferred equity investors receive priority return of invested capital ahead of the sponsor and joint venture investors. MEZZANINE FINANCING

Mezzanine financing is similar to a second mortgage, except that mezzanine loans are secured by the ownership interest of the company rather than the physical real estate. Mezzanine debt is junior to the first mortgage / senior debt, but takes priority over all equity positions. While mezzanine lending can provide a valuable tool for closing a gap between senior debt and equity investments, the structure can be messy, often requiring complex inter-creditor agreements between the mezzanine lender and the senior debt holder. Consequently, mezzanine lenders typically only look at larger projects that warrant the time and effort required for due diligence, negotiations, and paperwork. |